In a world where traditional banks and a flood of fintech startups jockey for supremacy in international payments, one name continues to stand out: XE Money Transfer. With over three decades of expertise in live exchange‑rate data, a proven track record of reliability, and a customer‑first approach to pricing and support, XE remains a go‑to platform for individuals and businesses alike. Ready to experience the difference? Sign up for XE Money Transfer today and discover why it still leads the pack in 2025.

A Legacy of Trust and Expertise

XE started life in 1993 as an online currency converter—long before smartphones, blockchain, or open banking entered the lexicon. Over the years, the company has built its reputation on:

- Accurate Exchange‑Rate Data: XE’s mid‑market rates power countless financial platforms and apps worldwide, making it the gold standard for real‑time currency information.

- Regulatory Compliance: Fully authorized by the UK’s Financial Conduct Authority (FCA) and registered with key regulators in North America, Europe, Asia, and Australia, XE operates under rigorous global standards.

- Global Infrastructure: With payment corridors spanning 170+ countries and support for over 60 currencies, XE’s network enables seamless transfers from New York to Nairobi, London to Lagos, or Sydney to São Paulo.

This deep foundation of trust and expertise differentiates XE from newer players that may excel in niches but lack the broad, proven track record XE brings to every transaction.

Transparent Pricing That Outshines Banks

Banks have long relied on hidden spreads—markups between the interbank rate and the customer rate—to generate profits. These spreads, often ranging from 2% to 5%, can significantly erode the value of every international payment. XE tackles this head‑on:

- Mid‑Market Rate Basis: All XE transfers start with the mid‑market exchange rate—the true interbank rate you see on Google or Bloomberg.

- Clearly Stated Margins: Instead of hiding fees in the rate, XE applies a modest, fully disclosed margin (typically 0.5–1.5%), so you know exactly what you’re paying.

- Flat or No Transfer Fees: For transfers under a certain threshold (e.g., $1,000), a flat fee (around $3–$5) applies; above that, XE often waives fees entirely.

- “Amount Received” Guarantee: The platform calculates the exact amount your beneficiary will receive, including all charges, before you hit “confirm.”

Compared to banks that surprise you at reconciliation time, XE’s transparent model builds confidence and ensures you get maximum value from every currency conversion.

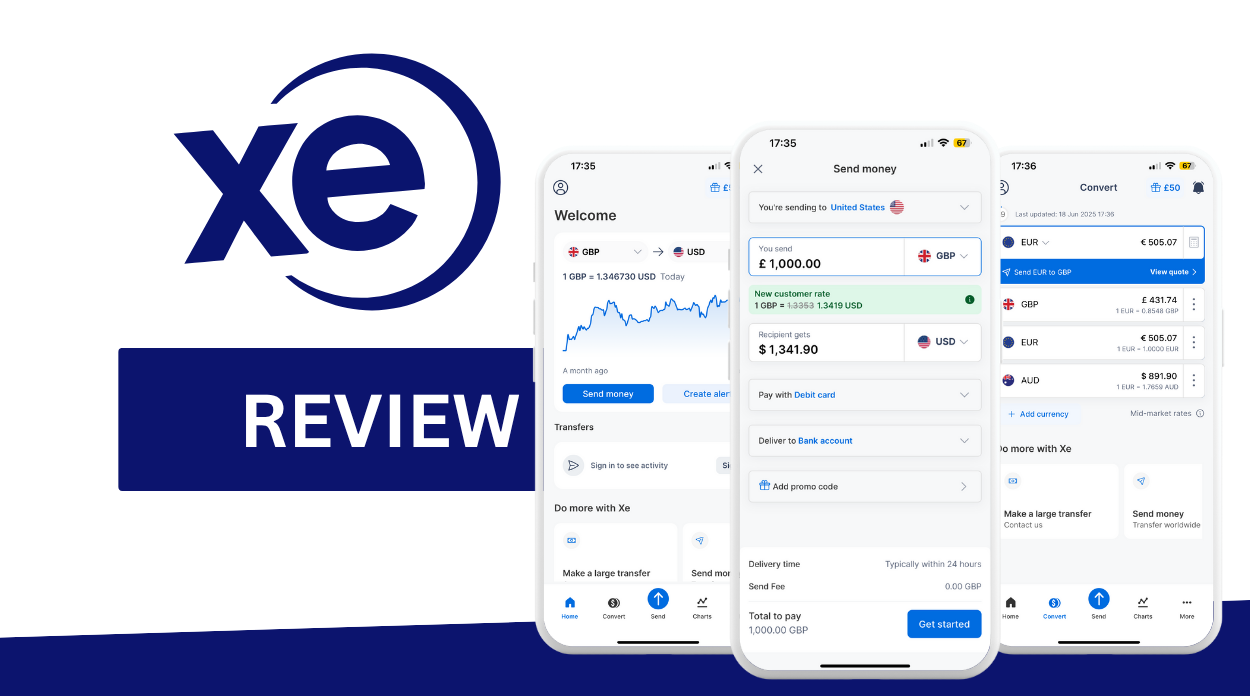

Cutting‑Edge Technology Meets Simplicity

While fintech startups often dazzle with advanced features, they sometimes sacrifice ease of use or reliability. XE strikes a balance by layering powerful capabilities onto an intuitive, streamlined interface:

- Real‑Time Rate Quotes: Instantaneous, live updating rates let you lock in the best value at the click of a button.

- Mobile and Web Parity: Whether you’re on the go with the XE mobile app or at your desk using the web portal, you enjoy the same robust features and seamless experience.

- Automated Rate Alerts: Set target rates for your currency pairs and receive push notifications or emails the moment your desired rate is reached.

- Batch Payments: Upload CSV files to send multiple payments in one go—ideal for payroll, supplier invoices, or contractor disbursements.

- API Access: For businesses and power users, XE’s API enables automated integrations with ERP, accounting, or treasury systems, driving efficiency at scale.

This combination of advanced features with straightforward design ensures that both novices and power users can move money across borders without friction or steep learning curves.

Market‑Leading Speed

Fast execution is a hallmark of XE’s service. Unlike banks that batch process wires once or twice daily, XE leverages a continuous‑processing engine:

- Same‑Day Settlement: For major corridors (e.g., USD→EUR, GBP→USD), transfers initiated before local cut‑offs often arrive the same day.

- 1–3 Business Days Worldwide: Even transfers to emerging‑market destinations usually complete within 1–3 days, outperforming many traditional providers.

- Cut‑Off Transparency: Regional cut‑off times are clearly displayed at quote time, letting you plan funding and submission to hit same‑day windows.

Whether you’re meeting payroll deadlines, funding a property purchase abroad, or paying crucial suppliers, XE’s speed ensures your funds land when they’re needed most.

Uncompromising Security

In 2025, data breaches and financial fraud remain top concerns. XE addresses these risks with multi‑layered security protocols:

- Regulatory Oversight: Licensed under the UK’s FCA and registered with authorities in Canada, the U.S., Australia, and more.

- Segregated Client Funds: Customer monies are held separately from XE’s operating accounts in tier‑one financial institutions.

- 256‑Bit SSL Encryption: Protects data both in transit and at rest, matching the highest industry standards.

- Multi‑Factor Authentication (MFA): Mandatory two‑factor authentication for all account logins and high‑value transfers adds an extra layer of safety.

- Advanced Monitoring: Real‑time transaction analytics and automated fraud‑detection systems flag anomalies and trigger manual review when needed.

- Ongoing Audits: Regular third‑party penetration tests and compliance assessments ensure systems remain resilient against evolving threats.

With these safeguards in place, XE provides peace of mind that your money and personal information are protected from end to end.

World‑Class Support and Service

Even the best platform needs strong support behind it. XE offers a multi‑channel, global support network:

- 24/5 Live Chat & Phone: Reach real agents in under two minutes on chat or ten minutes by phone, Monday through Friday.

- Email Assistance: Thorough written support for non‑urgent matters, with responses typically within one business day.

- Multilingual Teams: Support in over 100 languages ensures clear communication, no matter where you’re sending or receiving funds.

- Dedicated Business Managers: High‑volume and corporate clients receive personalized account management, strategic FX advice, and onboarding assistance.

- Comprehensive Help Center: Self‑service resources, including video tutorials, FAQs, and detailed guides, empower users to find quick answers.

This blend of proactive self‑help materials and responsive human support ensures that issues are resolved quickly and workflows remain uninterrupted.

Real‑World Use Cases

1. Remote Teams and Contractors

With the rise of global remote work, businesses need fast, cost‑effective ways to pay freelancers and contractors in different currencies. XE’s batch payments and mid‑market rates make payroll seamless, while mobile notifications alert payees when funds arrive.

2. Exporters and Importers

Supply‑chain management often involves large, recurring payments to overseas suppliers. XE’s forward‑contract and rate‑hold features lock in favorable rates, shielding businesses from currency volatility.

3. E‑Commerce Entrepreneurs

Online merchants selling internationally must convert multiple currencies quickly to manage cash flow and profitability. XE’s API integration automates the process, feeding real‑time conversions directly into accounting systems.

4. Personal Remittances

Families sending money across borders for living expenses, education, or healthcare can trust XE’s transparent fees and security measures. Fast settlement ensures recipients aren’t left waiting.

How to Get Started with XE in 2025

- Sign Up: Visit XE.com or download the XE app and register with your email address. Complete basic identity verification in minutes.

- Get a Quote: Enter the send amount and recipient currency to view live mid‑market rates plus any applicable margin and fees.

- Provide Recipient Details: Add bank account or mobile wallet information, ensuring accuracy to avoid delays.

- Fund Your Transfer: Choose your funding method—bank transfer, debit/credit card, or local rails like SEPA and Faster Payments.

- Confirm and Track: Review the final “Amount Received,” lock in your rate, and monitor progress via email, SMS, or the XE dashboard.

With just a few clicks, you can tap into XE’s global network and start making faster, safer, and more transparent international payments.

Conclusion

In 2025’s crowded landscape of banks, challenger banks, and ever‑emerging fintech firms, XE Money Transfer continues to carve out a leadership position by delivering unmatched reliability, transparent pricing, advanced technology, and world‑class support. Whether you’re an individual sending your first remittance or a multinational managing millions in cross‑border payments, XE offers a balanced blend of speed, security, and simplicity. Ready to join millions of satisfied customers? Create your XE account today and experience the enduring advantages that keep XE at the top.

Don’t settle for slow banks or half‑baked fintech solutions—sign up for XE Money Transfer now and elevate your international payments in 2025 and beyond.